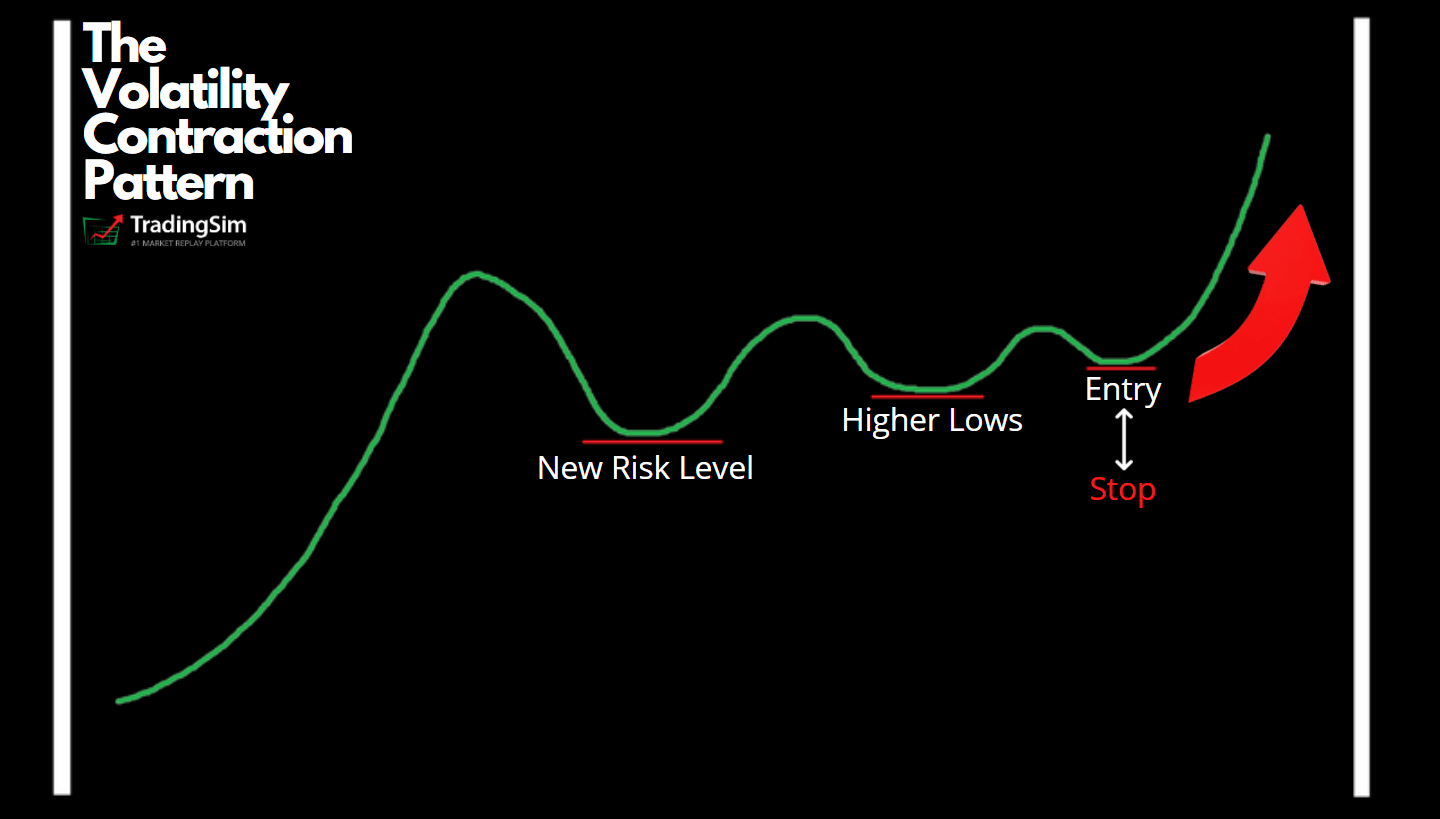

chartink vcp. The volatility contraction pattern (vcp) is a powerful technical analysis pattern developed by mark minervini to identify stocks with bullish potential and minimal risk. Backtest results will change/repaint as 2 different timeframes (daily & weekly) are used in the scan.

chartink vcp This characteristic appears in many chart patterns viz. Symmetrical triangle, an ascending triangle, a descending triangle, the mast of a flag, and many other places. Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc.

Get Realtime Data For Scanner In Our Premium Subscription.

The volatility contraction pattern (vcp) is a powerful technical analysis pattern developed by mark minervini to identify stocks with bullish potential and minimal risk. You can see the vcp pattern formation in any chart (if it is getting formed). Backtest results will change/repaint as 2 different timeframes (daily & weekly) are used in the scan.

Technical & Fundamental Stock Screener, Scan Stocks Based On Rsi, Pe, Macd, Breakouts, Divergence, Growth, Book Vlaue, Market Cap, Dividend Yield Etc.

Scanner guide scan examples feedback Symmetrical triangle, an ascending triangle, a descending triangle, the mast of a flag, and many other places. What is a volatility contraction pattern (vcp)?

What Is A Volatility Contraction Pattern (Vcp)?

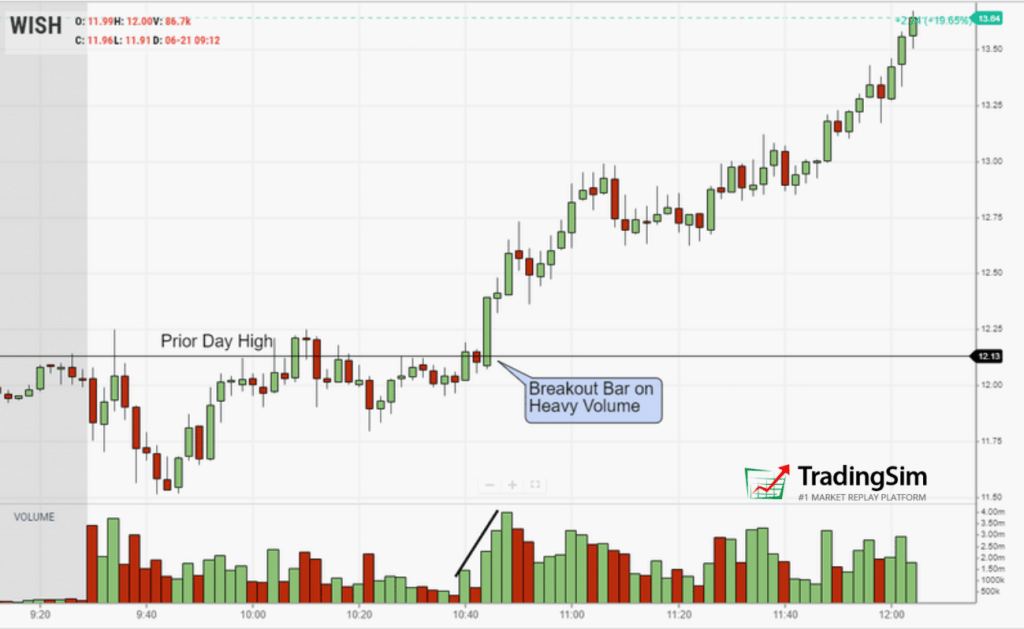

So, vcp is a characteristic in which there is a decrease in the price swing from a pivot high to a pivot low (measured in terms of percentage) inside a base from left to right. This characteristic appears in many chart patterns viz. The volatility contraction pattern (vcp) is a stock setup that trader mark minervini uses to spot potential breakout opportunities.